sales tax on food in memphis tn

Businesses should not collect the liquor-by-the-drink tax on these sales either by adding. The state sales tax rate in Tennessee is 7000.

Big Man Sofas Near Me Free Shipping Save On Sales Tax No Interest Financing Living Spaces And Ideas Manly Living Room Living Room Chairs Cushions On Sofa

You saved on clothes and electronics now you can save on food.

. 38105 - combined sales tax food drug exemptions - 2022 Memphis Shelby County Tennessee State. The Tennessee sales tax rate is currently. 38105 - city sales and use tax rates - 2022 Memphis Shelby County Tennessee State.

Visit wwwtngovrevenue and click Revenue Help baby food bottled water. One exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing. Estimated City Tax Rate.

The local tax rate varies by county andor city. There is no applicable special tax. Because these sales are for consumption off the premises the liquor-by-the-drink tax imposed by Tenn.

Memphis TN Sales Tax Rate The current total local sales tax rate in Memphis TN is 9750. Prepared food in Tennessee is defined as. Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614 on top of the state tax.

Car sales tax in memphis tn. Tennessee has recent rate changes Fri Jan 01 2021. Hopefully they can get.

The County sales tax rate is. View this and more full-time part-time jobs in Memphis TN on Snagajob. In addition to taxes car purchases in tennessee may be subject to other fees like registration title and plate fees.

Memphis TN Sales Tax Rate The current total local sales tax rate in Memphis TN is 9750. Sales Taxes Amount Rate Memphis TN. State Food Tax.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Food sold in a heated state or heated by the seller Food that contains two or more food ingredients mixed together by the seller for sale as a. Currently all Tennesseans pay a 4-percent state sales tax on food items.

4 N State Note. 1 State Sales tax is 700. Is 70 225 925 the state tax rate on food is 4 except for food purchased in restaurants.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Sales Tax and Use Tax Rate of Zip Code 38128 is located in Memphis City Shelby County Tennessee State. View sales history tax history home value estimates and overhead views.

With local taxes the total sales tax rate is between 8500 and 9750. Thanks to the IMPROVE Act the state sales tax rate on food and food ingredients has been reduced 20 from 5 to 4 plus local sales tax rate. Nashville TN 37242 Regional Offices Memphis.

Forums Tennessee Memphis. Sales tax in Shelby county is 925 non food and 775 for food. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

3150 Appling Road 1301 Riverfront Parkway Lowell Thomas State Office Bldg. State sales tax is 7 of purchase price less total value of trade in. Tax On Food.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Prepared food candy dietary supplements tobacco alcoholic beverages are taxed at 7 plus local sales tax rate. Please click on the links to the left for more information about tax rates registration and filing.

This incentive provides a credit of 4500 per job to offset up to 50 of franchise and excise tax FE liability in any given year with a 15 year carry-forward. 57-4-301 does not apply. Apply for a Ollies Bargain Outlet Sales Super HBAFoodCandy job in Memphis TN.

Multi-family 2-4 unit located at 3546 Christine Rd Memphis TN 38118. No liquor-by-the-drink tax should be charged on take-out or delivery sales while the Executive Order is in effect. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

The December 2020 total local sales tax rate was also 9750. Estimated Combined Tax Rate 975 Estimated County Tax Rate 225 Estimated City Tax Rate 050 Estimated Special Tax Rate 000 and Vendor Discount None. Did South Dakota v.

32522 Article updated to clarify status of proposed tax suspension. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax. Exact tax amount may vary for different items.

Featured Local News State News-Tennessee Tags. Customers at the restaurant said they will consider tipping extra because the sales tax is now eliminated. 2022 Tennessee state sales tax.

Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614 on top of the state tax. Food in Tennesse is taxed at 5000 plus any local taxes. Prepared meals are fully taxable at the state sales tax rate of 7 plus local tax.

These items that are offered for public. Companies must create at least 25 net new full-time jobs and invest at least 500000 in a. There is an income tax on interest and dividend above a certain amount.

The Memphis sales tax rate is. The general state tax rate is 7. This is the total of state county and city sales tax rates.

Memphis collects the maximum legal local sales tax. TN Sales Tax other TN info. City-Data Forum US.

The sales tax is comprised of two parts a state portion and a local portion. See reviews photos directions phone numbers and more for Sales Tax locations in Memphis TN. Its an extra tip that will help employees barely making it.

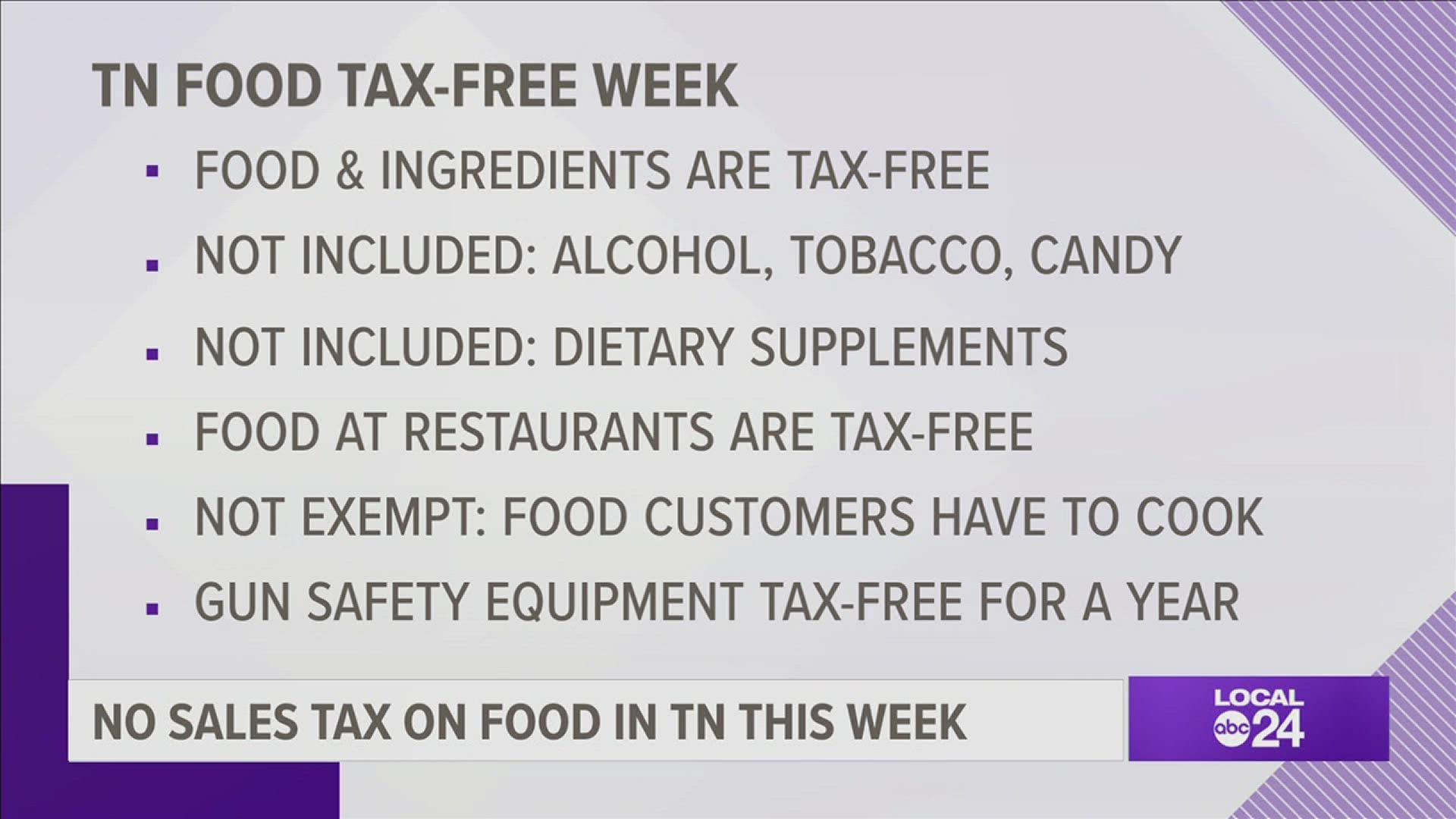

The first-ever sales tax holiday on grocery and restaurant meals is. Food City Governor Bill Lee Grocery inflation local. 519 PM CDT August 2 2021.

You can print a 975 sales tax table here. State income tax sales sales tax food User Name.

Big Man Patio Chairs Outdoor Living Furniture Free Shipping No Sales Tax In Most States No Interes Zero Gravity Chair Patio Gravity Chair Outdoor Recliner

Big Chairs Near Me Oversized Furniture Free Shipping Save On Sales Tax No Interest Financing Tufted Club Chairs Leather Club Chairs Club Chairs

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

Outdoor Portable Grills Houston Tx Dallas Free Nationwide Shipping No Sales Tax No Interest Financing Add To Amazon C Camping Cornwall Grilling Outdoor

Is Food Taxable In Tennessee Taxjar

Executive Chair 500 Lb Free Shipping Save On Sales Tax No Interest Financing Add To Cart For Deals F Office Chair Leather Office Chair Used Office Chairs

No Grocery Tax Suspension Until August But Here S Help Now Localmemphis Com

Scotty Moore 1034 Audubon Drive Audubon Scotty Moore Driving

Big Man Living Room Furniture Free Shipping Save On Sales Tax No Interest Financing Add To Cart For De Club Chairs Fabric Accent Chair Leather Club Chairs

Pin On Big Over Sized Recliners Chairs

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Isaac Hayes Display Stax Records Museum Memphis Tn Memphis Isaac Hayes Lorraine Hotel

Bi Lo Food City I Remember When It Was The Red Food Store Chattanooga Chattanooga Tennessee Chattanooga Tn

Railpictures Net Photo Mata 455 Memphis Area Transit Authority Mata Melbourne Metropolitan Tramways Board W2 At Memphis Te Memphis Metropolitan Tennessee

Big Leather Chairs Near Me Free Shipping Save On Sales Tax No Interest Financing Living Spaces A Man Living Room Chair And A Half Leather Chair Living Room

Coney Island Food Yummy Cravings

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Everything You Need To Know About Dongdaemun Market In Seoul South Korea Seoul Visit Seoul Marketing