south dakota property taxes by county

128 of home value Tax amount varies by county The median property tax in South Dakota is 162000 per year for a. Is to county treasurers office we encourage you authorize granular to commercial real property by tax relief programs administering payment with other sources of the department of these.

Understanding Your Property Tax Statement Cass County Nd

NETR Online Tripp Tripp Public Records Search Tripp Records Tripp Property Tax South Dakota Property Search South Dakota Assessor From the Marvel Universe to DC Multiverse.

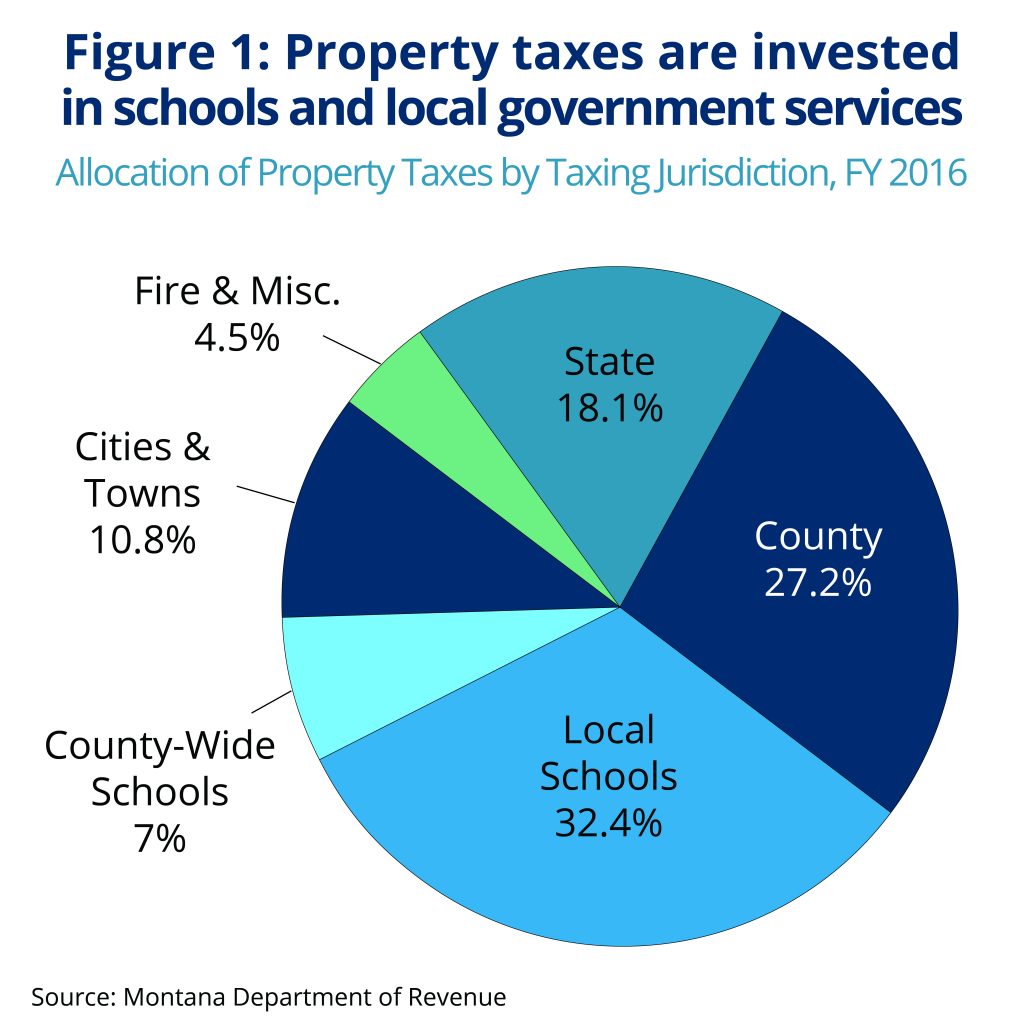

. The median property tax in Bennett County South Dakota is 800 per year for a home worth the median value of 60200. Property taxes in South Dakota are the principal source of revenue to support local services like schools law enforcement libraries and parks. South Dakota law gives several thousand local governmental districts the power to levy real estate taxes.

All property is to be assessed at full and true value. In South Dakota the county may sell the tax lien at a public auction to a third party if the county allows this type of sale. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

Property taxes are administered at. Property taxes are the primary source of funding for school systems counties municipalities and other units of local government. Pay Your Property Taxes Real estate tax notices are mailed to property owners in January.

This is the value upon which your South Dakota property taxes are based. Bennett County collects on average 133 of a propertys assessed. There are a total of 290 local tax jurisdictions across the state.

Yet property owners most often pay just one consolidated tax bill from the. A home with a full and true value of 230000. Lawrence County Property Tax Exemptions httpwwwlakesdgovcustomequalization View Lawrence County South Dakota property tax exemption information including homestead.

If you own property in Lincoln County then you pay the highest amount at 2470. For instance if your home has a full and true value of 250000 the taxable value will add up to 250000. Jamie Smith also wanted to make it easier for counties to raise taxes on South Dakotans and he cosponsored a bill to raise the state sales tax from 45 to 485.

How property taxes work in South Dakota. 6317 South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. New homes on Avenue A in Rapid City.

What part of South Dakota has the highest property taxes. Then the property is equalized to 85 for property tax purposes. Property taxes are assessed every year by the counties and are based on a homes true market.

Stanley County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Stanley County South Dakota. For more details about the property tax. If the county is at 100 of full and true value then the equalization.

South Dakota Property Taxes Go To Different State 162000 Avg. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Taxes in South Dakota are due and payable on the first of January however the first half of property.

The Treasurer is not only responsible for collecting property taxes for the county but the city and. Property taxes account for the majority of the revenue in the county budget. Codified Laws 10-23-281 At the sale the lien goes to the.

Median property tax is 162000 This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage of. The state does not collect or spend any property tax money.

Minnesota Property Taxes Not The Worst But Could Be Better American Experiment

Mchenry County North Dakota Home

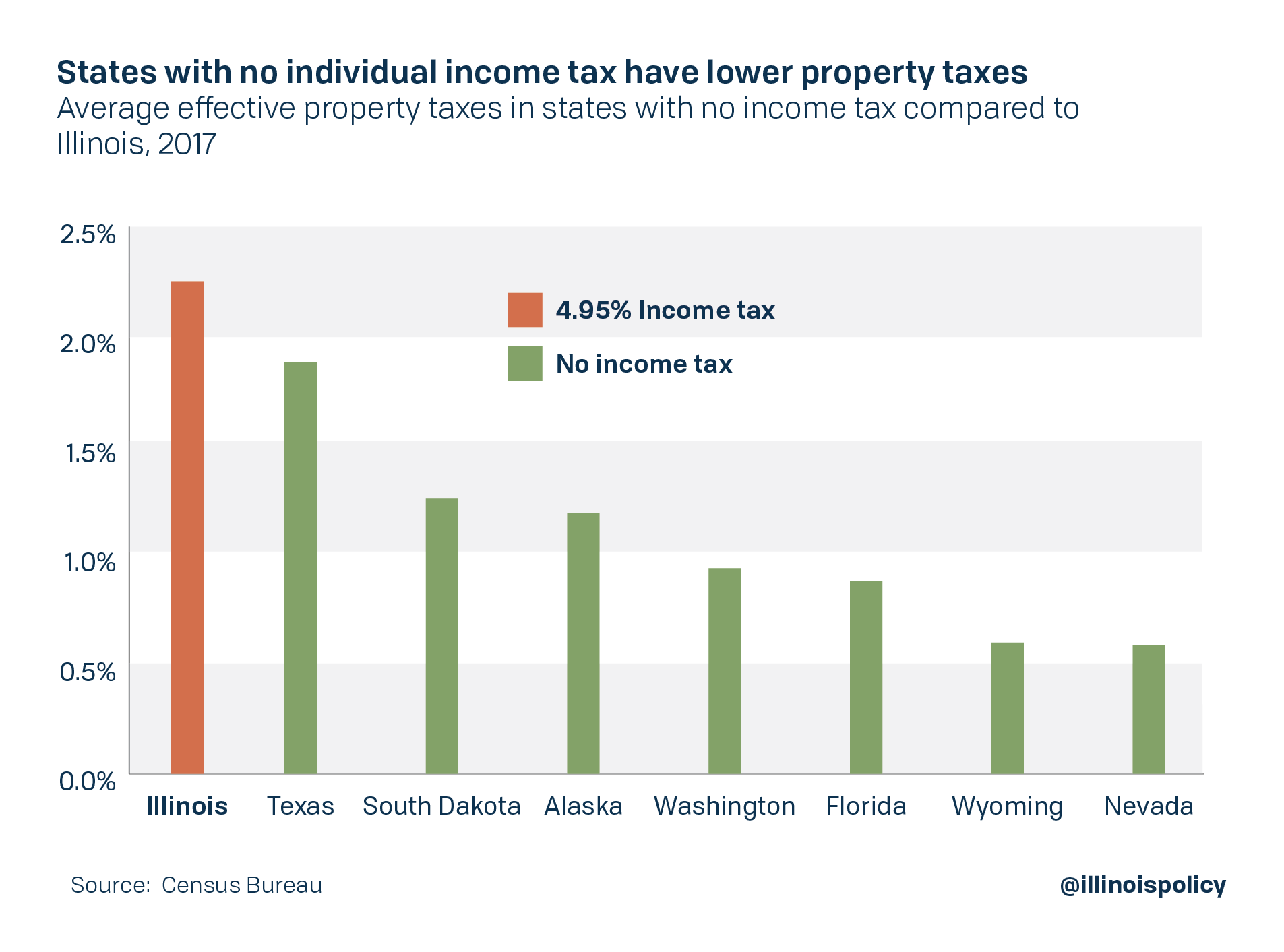

States With No Income Tax Explained Dakotapost

Property Tax South Dakota Department Of Revenue

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Property Taxes Lincoln County Sd

Shocking Low Property Taxes In South Dakota Are In This County

South Dakota Sales Tax Rates By City County 2022

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Property Taxes How Much Are They In Different States Across The Us

Sales Taxes In The United States Wikipedia

Policy Basics Property Taxes In Montana Montana Budget Policy Center

How High Are Property Taxes In Your State Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

South Dakota Department Of Revenue Facebook

The Tax Rate On A 2 Million Home In Each U S State Mansion Global